People often ask is Virtual CFO a good industry to be in ?

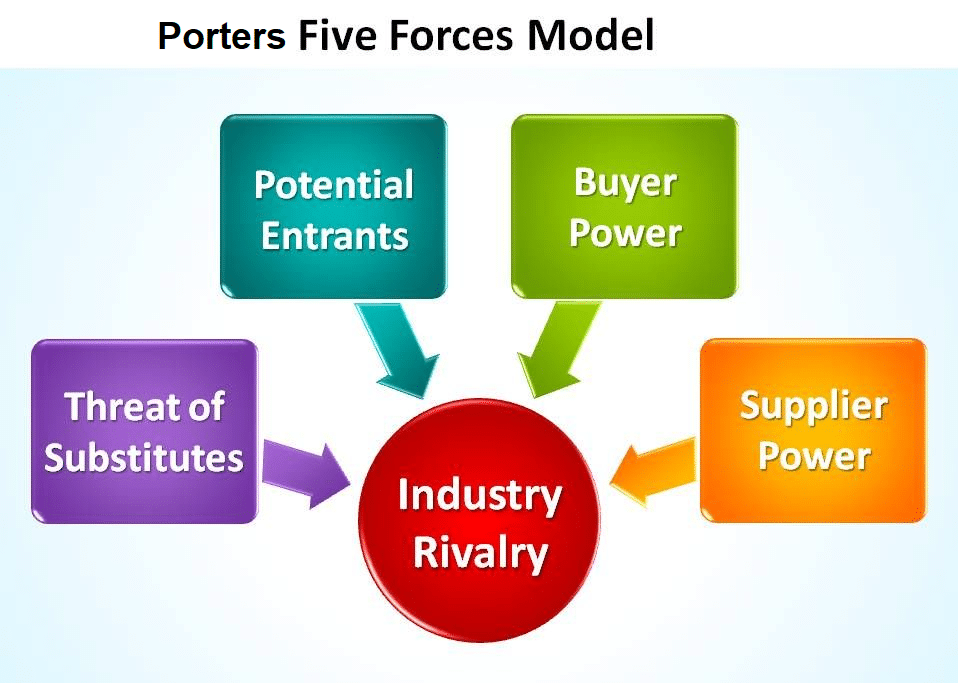

The best way of dissecting this and answering is to do a Porters 5 Forces analysis.

Competitive Rivalry

The rate of industry growth in this fast growing and emerging sector of the accounting profession means there is plenty of work to go around. The Association believes that we are better to join forces and create a compelling pool of expertise, then to fight amongst ourselves. Because we are all so individually different based on our extensive industry vertical expertise, we don’t represent threats to each other. The Association also has the 5 principles of collaboration which includes a no poaching rule. We believe that with collective experience totalling almost 500 years, across over 20 industry verticals that the Association members offer a more comprehensive, compelling solution to non-members.

Threat of new entrants

How hard it is for someone to come in and compete for market share against a VCFO’s offering?

The set-up costs are relatively insignificant. A desk, a laptop, website and phone. What isn’t insignificant is the comprehensive educational background and average of 25 years of corporate industry experience. You can’t accelerate getting these and you can’t do without them. Bookkeepers and compliance accountants can’t do a simple course to ‘convert’ and without the requisite expertise, clients and their businesses will be disappointed or even harmed.

Buyers’ Bargaining Power

Ultimately the client chooses who they work with and who they don’t. Clients have to realise though that the best Virtual CFO for them, will have many years of experience in their industry vertical. As such, it becomes a supply and demand issue. If you want expertise and there isn’t a huge pool of people to choose from, they don’t have much bargaining power. Most Virtual CFO’s are limited to about 10 decent sized clients, so they are careful about aligning themselves with the clients success. If clients chose on price alone, they will probably end up with a Virtual CFO that isn’t suited to their business or experienced enough to keep up with the bouncing ball.

Suppliers’ Bargaining Power

Is relatively weak. Virtual CFO’s are technology enabled, but software agnostic. That is, the software itself isn’t the ‘secret sauce’ of what we do. Whilst we do factor in clients preferences and switching costs, there are often several options we could use for out clients, meaning we aren’t beholden to any particular supplier.

Substitutes and Complements

When people start to question the value of something, they might look towards an alternative, or substitute. An example would be someone who likes going to the theatre to see live performances, but finds that the cost has become prohibitive and that for a fraction of the price they can go to the movies and still be entertained.

Given Virtual CFO’s have an average of around 25 years of industry experience, it makes it hard for someone without that experience to come up with a credible alternative, compelling reason to switch. The biggest obstacle Virtual CFO’s encounter as a substitute, is from the clients employing a full-time CFO. That said, someone with half the experience, that works twice as long isn’t the same thing.

Summary

We don’t think there has ever been a more exciting time to be starting out in this fast growing and emerging sector. Uptake of Virtual CFO services in the broader business community is steadily growing. Virtual CFO has now also been around long enough to have client advocates and testimonials to vouch for the value provided by having a VCFO.

If you look at the USA and Europe, Virtual CFO is more common. They are early adopters; Australia are the laggards.

“Australian firms have fallen behind firms at the global productivity frontier over recent years.” Treasury deputy secretary Meghan Quinn said.

Virtual CFO’s enabled by cloud accounting can offer huge efficiencies compared to the traditional model. Australia is recognising we are falling behind, we are a resourceful nation and as people look to reduce inefficiency, waste and excess, they will soon realise the value in having a VCFO.