100 years ago the flywheel delivered power from a motor to a machine.

Today a different type of flywheel is needed to give your business

- momentum

- remove friction

- Apply Force

- Give your Business Flow, Accuracy & Accountability

1 in every 3 Australian businesses operating in 2017 failed to survive until 2021 because of lack of planning.

Planning alone can’t save your business, you need an actionable roadmap, a Budget to help you achieve your Plan.

A Plan without a Budget is just a daydream

A Budget without a Plan is a nightmare

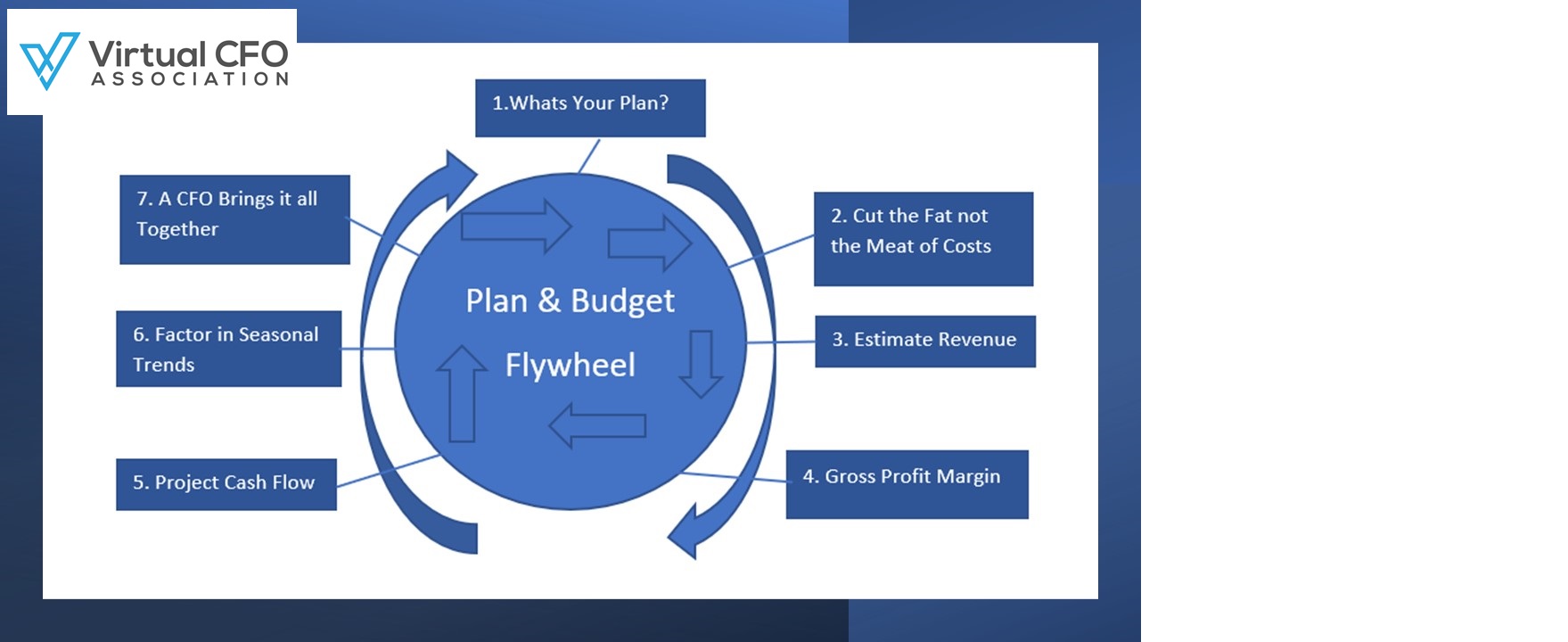

The Solution is a Plan & Budget Flywheel, working in unison, not just one or the other but both.

With a New Financial Year just a few months away, inflation and supply chain issues causing uncertainty, follow the 7 Steps on the Flywheel and you’ll be building the right momentum to success.

- What’s Your Plan?

Define your Plan and decide whether you have the cash flow to help you get there. Do you need to borrow money, get a loan? How are you going to fund your Plan? How do you deal with a short-term cash shortage? These are the critical questions you need to face up to.

- Cut the Fat not the Meat of Your Costs

Analyse all your costs, understand you have fixed and variable costs. Negotiate with your suppliers to get discounts by giving them commitment that you will be their Supplier of choice. Every $ counts. Get efficient. Don’t be an Open Bar tab, put purchasing limits in place and sign off’s and it all starts with putting it in your Budget and making yourself accountable to what you are spending.

- Estimate Revenue

Looks at prior revenues, talk to potential customers, set realistic goals, adjust for seasonal fluctuations, like Xmas and holidays.

- Gross Profit Margin

This is one business metric you can’t live without. No matter how many sales you make you have to know all your costs that went into that sale and how profitable it was. Yes you are in the business of making money, because if you don’t your competitor will. So get in front of the pack, Be Profitable Be Proud!

- Project Cash Flow

They say Cash is King for a Reason, so many businesses are caught without cash because they are waiting for their customer to pay. Look at trading terms, get money in advance of starting work, look at debtor finance scenarios…..make sure your cash flow is king all the time.

- Factor in Seasonal & Industry Trends

What happens if your industry only gets revenue during summer? How do you survive during winter. You need to budget for low revenue months and hope that you have enough revenue banked up in the bank to get you through the leaner months.

- Bring it All Together

A CFO will combine your Plan and Budget together, pull the numbers together and update them against actuals so you can see how you are tracking. Your budget teaches you valuable lessons about you and your business. It’ a life journey and we help you along your journey to success.

#virtualcfo #smes #financialmanagement

Chris Kondou is a member of the Virtual CFO Association.

The Virtual CFO Association is an elite peer network, advocating and promoting the emerging VCFO sector within the accounting profession. Collectively the association currently has over 600 years of industry experience, with highly qualified and experienced specialists spread across more than 25 industry verticals. If you would like any more information regarding the Association of VCFO’s, please visit our website www.vcfoassociation.com.au