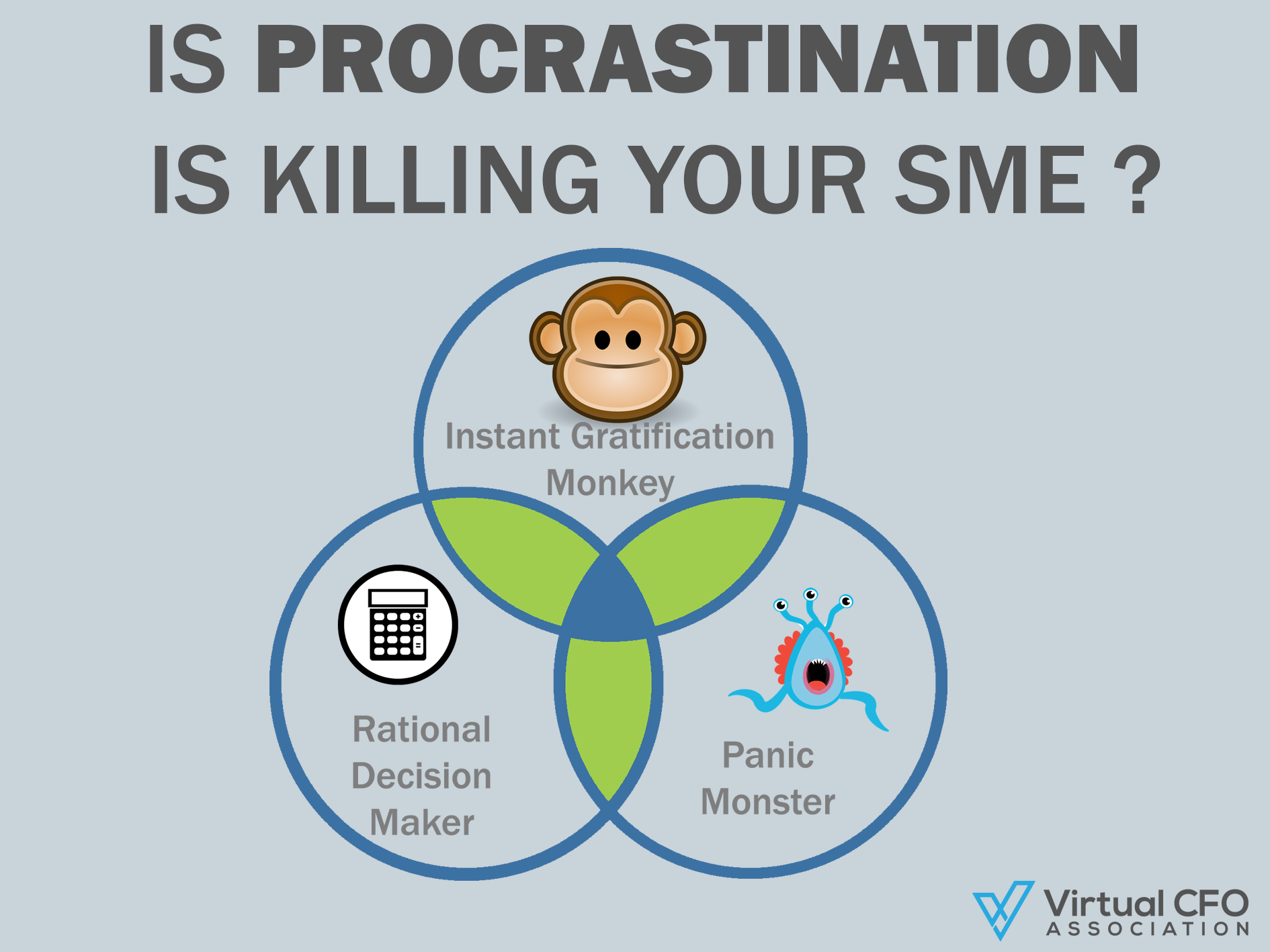

I wanted to share Tim Urban’s framework called the Procrastinator’s System ( see link to TED talk https://www.youtube.com/watch?v=arj7oStGLkU), to represent what goes on in our heads. PS consists of three characters:

- Rational Decision-Maker

- Instant Gratification Monkey

- Panic Monster

The Rational Decision-Maker wants to take information on board then decide the best course to take and to do something productive right now.

The Rational Decision-Maker gives us the ability to :

- Visualize the future

- See the big picture

- Make long-term plans

Significantly, these are things no other animal on earth can do:

The Instant Gratification Monkey lives entirely in the present moment. He has no memory of the past, no knowledge of the future, and he only cares about two things: easy and fun. The Monkey causes us to avoid the hard stuff.

When the Rational Decision Maker and the Monkey to agree it leads to awesome play and fun times.

But when it makes sense to roll your sleeves up and do harder stuff (not the fun things) this causes conflict in your head and the Monkey often wins. When the Monkey wins, we procrastinate and waste our time on stuff we shouldn’t. When we procrastinate, easy and fun activities happen when we should be sweating or swotting.

The Panic Monster is dormant most of the time, but he wakes up anytime:

- a deadline gets too close, or

- there’s danger of public embarrassment.

The Monkey fears the Panic Monster When the Panic Monster shows up, the Monkey straight away cedes control to the Rational Decision-Maker.

There are 2 kinds of procrastination:

- Procrastination on hard things WITH deadlines

- Procrastination on hard things WITHOUT deadlines

Now remember, the Panic Monster gets involved when deadlines near. However, when there are no deadlines the Panic Monster doesn’t gets triggered, and we are free to procrastinate forever. This type of long-term procrastination is often less visible and usually suffered quietly and privately. It can lead to long-term unhappiness and regret.

If you’re entrepreneurial, it’s easy to think there are no real deadlines or no real danger of public embarrassment if you’re not managing your business properly. As a result, things can tend to drift along because the Monkey allows it to. The Monkey allows you to live in the moment, push the hard stuff to the side, and hope for a better future where making money is easier than it is now.

But, your life is the ultimate deadline.

Time is ticking, we all only get a finite time on the planet and that alone should kick your panic monster into action and seek out an expert Virtual CFO to help you visualize the future, see the big picture and make long-term plans.

David Dillon is the President of the Virtual CFO Association.

The Virtual CFO Association is an elite peer network, advocating and promoting the emerging Virtual CFO sector within the accounting profession. Collectively the association currently has almost 600 years of industry experience, with highly qualified and experienced specialists spread across more than 30 industry verticals. If you would like any more information regarding the Association of Virtual CFO’s, please visit our website www.vcfoassociation.com.au

#sme #virtualcfo #accounting