Everyone knows you wouldn’t try to dig a hole with a hammer. Both are good tools, the tool itself isn’t the problem, but you need to use the right tool for the job.

Flying by the seat of your SME pants?

Many SME owners are finding that “keeping up with the bouncing ball” as their business becomes more complex, has more moving parts etc, is harder and harder for them and their team. Most of these think if they have a tax advisor and a bookkeeper, they should have all their bases covered. But their, profitability is often disappointing, and they feel like they are being dragged away from what they should be doing (focusing on clients’ needs and delivering on promises) and pulled into a daily battle with their financial management problems. Even after they have ‘doused the spot fires’ they feel like they are flying by the seat of their pants. Does this sound familiar?

Tax Accountants and bookkeepers

A bookkeeper’s role is to record the day-to-day financial transactions of a business and bring the books to the trial balance stage. Over the years that role has changed dramatically with the advent of desktop accounting programs like Xero, QB’s and MYOB. These programs work with other efficiency enabling tools, that can scan images and code them and as a package it saves a bunch of time. But a bookkeeper is still only a bookkeeper, that just they are using power tools not hand tools.

Tax/advisors offer strategic advice to help accumulate and protect private wealth, using tax structures to legally minimise tax. Often the ‘touch points’ between client and advisor are relatively infrequent with a retrospective focus.

But here’s the thing; the best tax accountant in the country, using the cleverest tax structure has nothing to do until your business has a profit to push through the structure. Virtual CFO’s focus is to reduce inefficiency and maximise profit.

Virtual CFO’s

Virtual CFO’s are fully qualified accountants, with many years of commercial / industry experience to make them experts in businesses like yours. Most have worked in larger companies and have seen the systems and processes that are needed to successfully grow and have many years of experience working with boards of directors and C-suite executives as they thrash out strategies to survive and prosper.

To put some context around that, collectively, amongst the Virtual CFO Associations elite peer network we have over 500 years of industry experience spread across over 20 industry verticals. This gives our members a very compelling point of difference in the market. Confidence for members and comfort for clients.

Different Types of Accountants

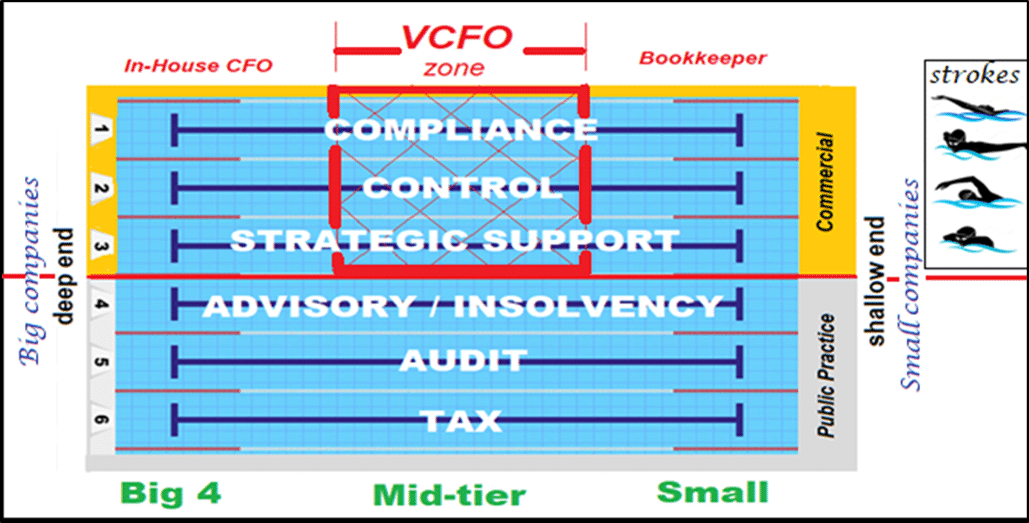

The best way to explain the difference between accountants is imagining if accounting were a swimming pool.

Then split the pool length-ways in 2 halves. One half is public practice, the other half commercial. (see feature image):

Lanes are split by tax, audit, insolvency and restructuring. Commercial lanes are split by compliance, control and strategic support, with management accounting, financial accounting, treasury, systems, risk and compliance nesting beneath.

Small business is at shallow end, Big companies up the deep end.

At the shallow end, you can stand up, but at the deep end, you’ll sink if you can’t swim.

That’s why Big 4 (public practice) tend to stay in their lanes and specialise. The more laps you do in a lane, the bigger stronger and faster you become until you become a partner, or lane champion. They don’t try to swim across lanes at the deep end of the pool. They niche. The bigger the firms are, the deeper they can dig into a niche, say perhaps a Specialist Payroll tax expert in each state, that the other states can call upon. Smaller firms simply can’t do that and at best end up as “jack of all trades’

In commerce, experience allows you start to swimming across lanes. CFO’s generally prove they can swim across the pool at the shallow end, before they attempt it at the deep end, i.e. they work their way up to ASX100 companies, learning the ropes in smaller companies first. Industry verticals, such as manufacturing, retail, shipping, banking etc also come into it. Think of these like different swimming strokes. Sure, CFO’s can learn other industries, but the person swimming a medley isn’t as strong as a specialist. It’s the same for CFO’s – 10,000 hours is the accepted benchmark for understanding an industry well.

There is a definite sweet spot for Virtual CFO’s in the mid-tier range, the smaller companies probably haven’t reached a stage where they really need the full range in a VCFOs expertise, nor can they justify the investment. Larger companies generally have navigated through this stage of the business growth life-cycle to the other side and can justify a full-time CFO internally.

Tax advisors and bookkeepers are far better off when they acknowledge the value of a commercial financial management expert like a Virtual CFO to fill a void for their clients than attempt to do it themselves. Public Practice Accountants who see VCFO as an area they can learn and ‘upsell’ to their clients are often taking a huge risk, at the expense of their unsuspecting clients. Clients need the help and without the Accountant having the right skill set their needs will go unfulfilled or something far worse.

To put some context around that, collectively, amongst the Virtual CFO Associations elite peer network we have over 500 years of industry experience spread across over 20 industry verticals. Under our spirit of collaboration, we can call upon other members for specific industry or software experience. This gives our members a very compelling point of difference in the market. Confidence for members and comfort for clients.

Make sure you use the right tool for the dynamic financial management of your business – strategy, reporting, budget, forecast and cash flow management; use a member of the Virtual CFO Association.

David Dillon is a committee member of the Virtual CFO Association.

The Virtual CFO Association is an elite peer network, advocating and promoting the emerging Virtual CFO sector within the accounting profession. Collectively the association currently has over 500 years of industry experience, with highly qualified and experienced specialists spread across more than 20 industry verticals. If you would like any more information regarding the Association of Virtual CFO’s, please visit our website https://vcfoassociation.com.au/