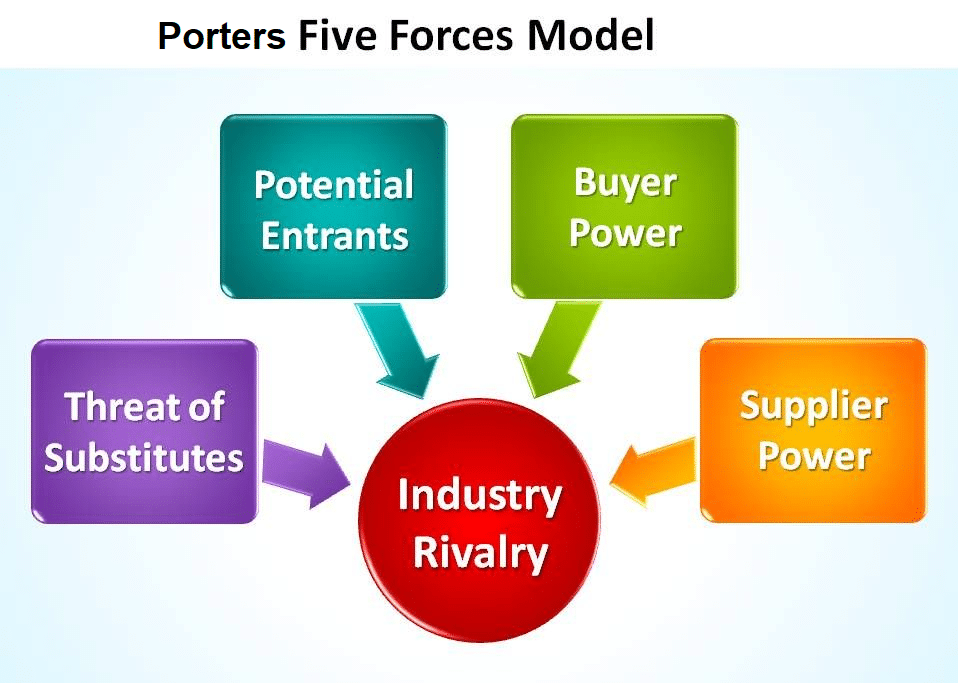

The best way of dissecting this and answering is to do a Porters 5 Forces analysis.

Competitive Rivalry

The rate of industry growth in this fast-growing and emerging sector of the accounting profession means there is plenty of work to go around.

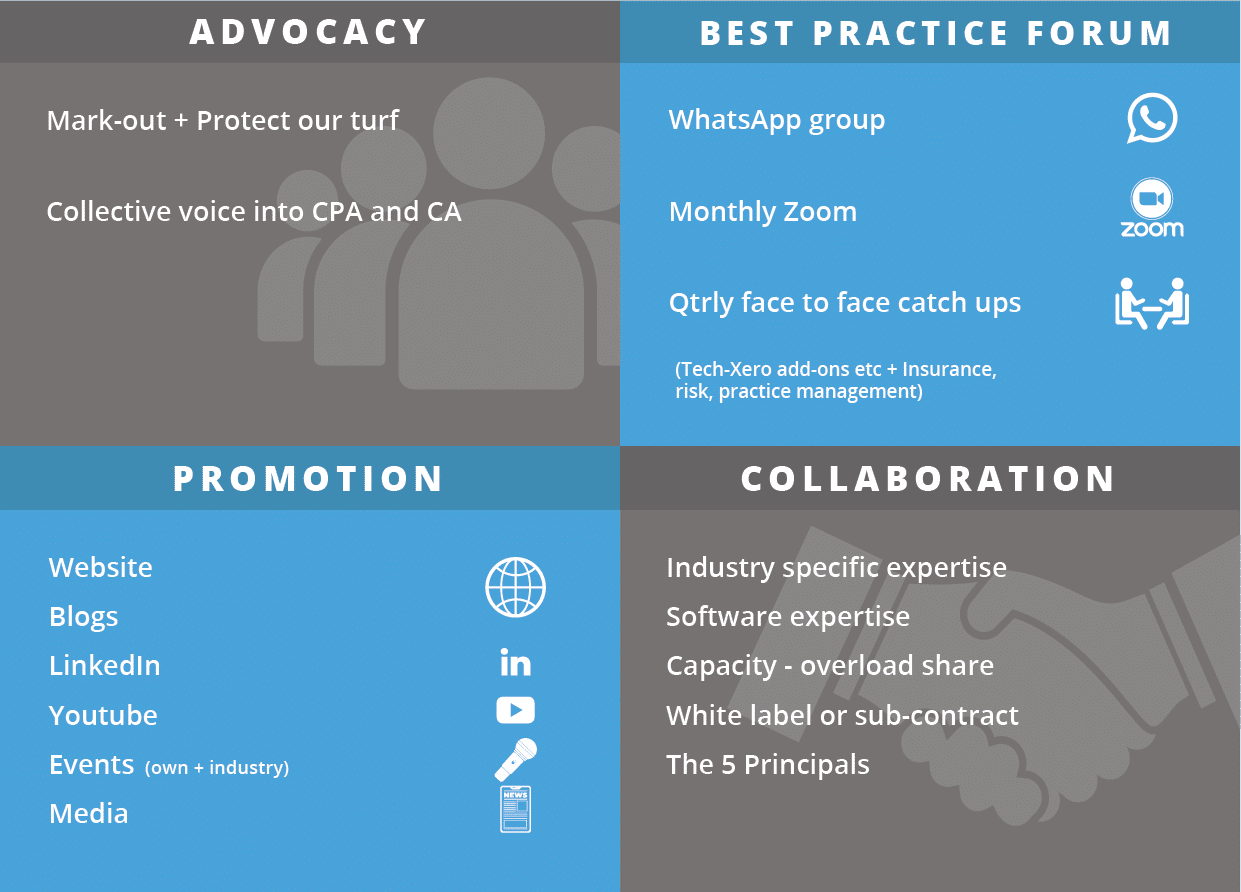

Because we are all so individually different based on our extensive elite industry vertical expertise, we don’t represent threats to each other. If anything, we complement each other’s skillsets, which allows us to cover more ground and dig deeper than any other Virtual CFO organisation in the country. The Association also has the 5 principles of collaboration which includes a no-poaching rule. We believe that with collective experience totalling almost 500 years, across over 20 industry verticals that the Association members offer a more comprehensive, compelling solution to non-members and solopreneurs.

Threat of new entrants

How hard it is for someone to come in and compete for market share against a VCFO’s offering?

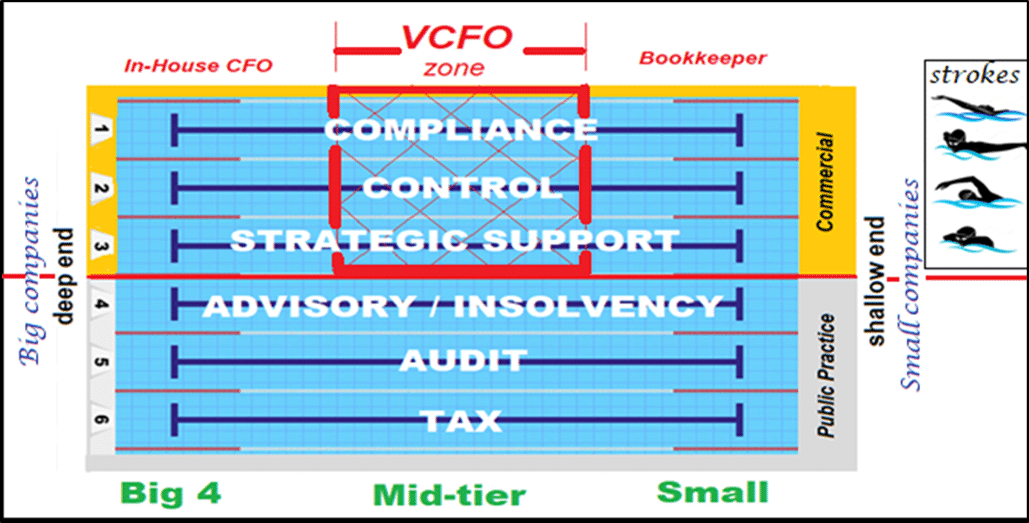

The set-up capital costs are relatively insignificant. A desk, a laptop, website, phone and enough cash in the bank to last until your business is profitable. What is not insignificant is the comprehensive educational background and average of 25 years of corporate industry experience. You cannot accelerate getting these and you cannot do without them. Bookkeepers and compliance accountants cannot do a simple course to ‘convert’ and without the requisite expertise, clients and their businesses will be disappointed or even harmed.

The twin crisis has given Virtually every CFO a taste of life as Virtual CFO. For many CFO’s, through no fault of their own, they will find themselves underemployed or worse and needing to find work as a Virtual CFO. For others, the crisis represents an opportunity to capitalise on their immense expertise and start a consulting Virtual CFO business. But getting off the ground, starting a business from scratch is tough, as all our members know from experience.

Buyers’ Bargaining Power

Ultimately the client chooses who they work with and who they do not. Most clients realise that the best Virtual CFO for them, will have many years of experience in their industry vertical. As such, it becomes a supply and demand issue. If you want expertise and there is not a huge pool of people to choose from, they don’t have much bargaining power. Virtual CFO is not a commodity. Most Virtual CFO’s are limited to about 10 decent sized clients, so they are careful about aligning themselves with the client’s success. If clients chose on price alone, they will probably end up with a Virtual CFO that isn’t suited to their business or experienced enough to keep up with the bouncing ball.

Suppliers’ Bargaining Power

Is relatively weak. Virtual CFO’s are technology-enabled, but software agnostic. That is, the software itself isn’t the ‘secret sauce’ of what we do. Whilst we do factor in client’s preferences and switching costs, there are often several options we could use for our clients, meaning we are not beholden to any particular supplier.

Substitutes and Complements

When people start to question the value of something, they might look towards an alternative, or substitute. An example would be someone who likes going to the theatre to see live performances but finds that the cost has become prohibitive and that for a fraction of the price they can go to the movies and still be entertained.

Given Virtual CFO’s have an average of around 25 years of industry experience, it makes it hard for someone without that experience to come up with a credible alternative, compelling reason to switch. Historically the biggest obstacle Virtual CFO’s encounter as a substitute, is from the clients employing a full-time CFO. Mostly that has been due to psychological inertia and fear of the unknown. Often the internal CFO option they chose is someone with half the experience, that works twice as long, but that isn’t the same thing as a 25+ year industry experienced expert. The twin crisis has changed that and proven the Virtual team / remote working model can work. In fact it has been the ultimate in validation.

We do not think there has ever been a more exciting time to be starting out in this fast-growing and emerging sector. If you look at the USA and Europe, Virtual CFO’s are more common, and more known across the business world. They are early adopters; Australia has been the laggards, but uptake of Virtual CFO services in the broader business community is set to explode as the economy gears up for a re-start.

Virtual CFO’s enabled by cloud accounting can offer huge efficiencies compared to the traditional model. We are a resourceful nation and as people look to reduce inefficiency, waste and excess, they will soon realise the value of having a Virtual CFO.