Everyone starts somewhere.

Harry was a very talented young architect. His fascination with drawing buildings started as a kid. Throughout school he continued his passion and did very well at tech-drawing. This led him to enroll in Architecture at University. Eventually he graduated and came top of his class at University, staying on to do his Honors year. His final year thesis project, a sustainable adaptive re-use of an old mining site, was lauded for its cutting-edge innovation.

Corporate disillusionment

Offers to join large firms on their graduate program came flooding in for the top students and Harry picked the firm that he felt best complimented his design style. He expected to spend a couple of post-grad years learning the ropes, working under the main designers and honing his craft, before being given a chance to showcase his own talents and flair. But it wasn’t what he’d hoped it would be. In fact, Harry felt he’d been sold a dream that was never likely to happen. Harry felt his talent was being wasted, so he became disillusioned, jaded and cynical.

Deciding to go out on his own

It turned out to be what Harry thought was an ‘Architectural factory’. Due to an immediate pressing need at the time, the firm used Harry in their documentation team and the firm had plenty of more senior designers ahead of him in the pecking order. He was good at the CAD software, but it was unfulfilling work for him, and he wasn’t using anywhere near the full range of capabilities that he had in his tool bag. His turn would come they said, but he wasn’t so sure. So, Harry decided to go into business himself so he could cut ‘free’ of the documentation curse to pursue a creative path of his choosing.

Lucky Break

But the pursuit of excellence comes at a cost. To pay the bills, Harry, who was working solo at this stage, in the basement of his cousin’s bike shop, had leaned on his personal network and picked up a handful of domestic, residential extensions and renovation projects.

His lucky break came when Harry won an International design competition, with a scheme that built on the foundations of his University thesis.

As you might expect, with this win, Harry’s business took off. He hired his first employee, a friend from university, then his second and then more. He moved from the basement and into a co-working office space and very soon found himself signing a lease for an office of his own. It grew so quickly in fact that he was struggling to remember everyone’s name as he moved around the office.

Draw me the Money

Harry was on a roll and he felt that he needed to capitalize on his newly enhanced reputation and keep the momentum going. He had seen a quote by Richard Branson offering the sage advice— ‘If somebody offers you an amazing opportunity but you are not sure you can do it, say yes – then learn how to do it later!’

Harry kept saying yes.

Revenue and staff numbers had doubled year-on-year for a few years. Harry’s company were continuing to win competitions, they were being featured in magazines, had won several prestigious architectural industry awards along the way and they had developed a great design culture within the team.

But they weren’t particularly profitable.

Hard Slog and frustration:

Harry was starting to understand that professionalism, self-satisfaction, delighting the customer + making a profit, are often conflicting priorities in Architecture projects.

Harry joined a practice management peer group and learned that the others were also facing many challenges just like him.

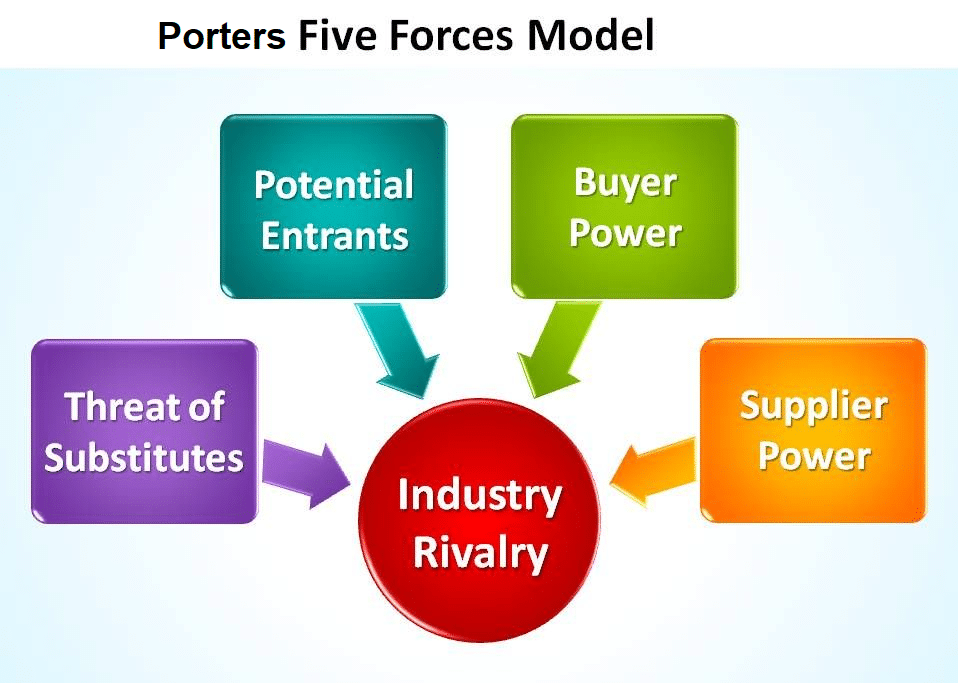

- Downward pressure on fees: the smaller boutique firms with lower overheads and a cost advantage, were willing to undercut on price to get themselves into the mix on bigger projects.

- Limitless Scope of Works: seemingly limitless risks, often subsequently novated to litigious builders

- Graduates: are coming out of the Universities, with little or no appreciation for the value of their time, coupled with a scant understanding about finances, project management, scope and earned value.

- Technology: is moving at such a rapid pace but has created little in the way of ‘net efficiency’. Whilst very impressive for the clients, in fact generate little if any profit for the firm.

Harry’s other problem was that the team that he’d built, including finance, HR and Admin, were the best people that he could find, with the salary he could afford to offer at that point in time. They had helped him grow to this point, they were loyal, hardworking and lived and breathed the company culture. He felt a deep sense of gratitude to them, but it didn’t stop the fact that he felt was flying by the seat of his pants, stressed out, worried about finances and getting pulled away from what he needed to be doing. Deep down he knew that this wasn’t an elite, top-shelf team of people, more so a group of technicians, who through no fault of theirs, were now standing in water in over their heads.

A cry for help:

After years of pushing himself to the brink of endurance and with the weight of the world upon him, Harry went to see his trusted advisor Wilson for his routine annual appointment. When Wilson calculated that Harry owed $120K in tax, he broke down and sobbed uncontrollably. He said “That $120K was to send my son to boarding school, for a better education. Now he can’t go. Why is it so hard, why?”

Wilson comforted his client and counselled him, offering “mate you need to work smarter not harder – you need to take a break also, you’ll end up killing yourself”

Luckily for Harry, his accountant Wilson, being an ethical operator and always wanting the best outcome for his clients told him that while tax accountants like him were great at setting up clever, but legal, structures to minimise his tax and protect his assets, the internal financial management of the business wasn’t something they did particularly well, but they knew exactly who could help.

His accountant recommended that Harry meets with an ex-CFO called Andrew who was running an outsourced Virtual CFO (otherwise called outsourced CFO or VCFO) business, that specialized in Architecture practices. Harry asked “Why do I need a CFO? What does a virtual CFO do for a small business?”

The Tax Accountant replied “Because your business has reached a critical point, where you can no longer manage without access to a seasoned, strategic and commercial thinker. Virtual CFO’s have that in abundance. Trouble is you can’t survive without one, but you haven’t yet reached the scale to be able to justify the investment in a full-time internal CFO.”

He went on, “Harry, it’s a catch 22, the team you have can’t keep up with the bouncing ball, but you can’t afford to employ an expensive CFO. A Virtual CFO solves that problem because your SME can access the expertise on an as-needs basis.”

Harry then asked, “how much would a virtual CFO cost?”

“Well, you only pay for it when you need it, so it works out to be a fraction of the cost of a full-time CFO and much better value.” His accountant went on to explain

Harry then asked, “what does a Virtual CFO do?”

“They manage the finances across all aspects of your business, as well as spanning the past present and future”, was the reply by the Tax Accountant.

4 Biggest Problems

Harry agreed to meet with the Andrew Virtual CFO. Together they went out for a coffee at Harrys favorite café.

“Tell me Harry, Wilson says things aren’t going so well” Andrew said

“It’s super frustrating Andrew” said Harry, “ We are good at winning the work, we don’t really compete on price, we have loyal customers, we do great work, we have good staff and I’m making millions in revenue, but we are lucky to make even a small profit” From what I can figure out the biggest problem is that “we always seem to spend half of the fee finishing the last 20% of the work”

Harry then went further and explained how this wasn’t how he imagined life as a business owner. “Andrew” he said,” I would have been better off staying in the ‘documentation factory’ on wages. How can I change things?”

“Well Harry” said Andrew, these are the 4 main problems that are fairly typical of architecture practices that I think you’ll be having:

- You are winning work without understanding what the cost is, that is, you aren’t building a detailed cost budget. When you ‘win’ the job, you are hoping to make a profit. Hope isn’t a great strategy.

- You are delegating it to someone who has never before been trained in the methods of Project Management. The only objective way to work out if you are making money or working outside the agreed scope is to do Earned Value Analysis (EVA).

- Definition of success for staff isn’t aligned with the firm. If you ask your staff to define success, they will say winning awards, leaving behind a legacy, gaining publicity in a magazine, having a happy customer, completion on-time etc. – by this stage nobody will have mentioned making a profit. Further, your rewards and incentives don’t tie back to the firm’s objective of making a profit.

- People are ‘washing off’ time to marketing codes – so they don’t kill the project. Firms are usually good at managing project time and general office time, but not marketing. It becomes a bit of a black hole that is devoid of accountability. You’ll hear managers and directors even say, “I can’t charge that to the project, it will kill it” But at their rates, it’s the ineffective and ineffective use of time doing ANYTHING, that kills the firm.

Expert Solutions

Harry listened on intently as Andrew explained, Virtual CFO’s will embed the solid commercial foundations needed to manage the business properly. Without a holistic package of the 5-pillars of financial management; Strategy, Budgeting, Reporting, Forecasting and Cashflow Management, the company will continue to bounce from issue to issue out of control, flying by the seat of its pants.

Andrew told Harry, “reliability and predictability are essential to both evaluate how your strategy is working currently, as well as having visibility of what lays ahead and the lead time to adjust if required. Planning becomes even more critical, as does strategic decision making.”

One of a few aspects your firm has the ability to control is tracking and managing the project’s progress in terms of the SCHEDULE and FINANCIAL PERFORMANCE using Earned Value Analysis (EVA).

EVA can shine a spotlight on out-of-scope work, or unforeseen problems, giving you an early graphical (per below) ‘heads-up’ and chance to manage the best outcome.

Harry is interested enough to listen, intelligent enough to understand and determined enough to implement the 5-pillars of financial management that he had implemented with Andrew help, along with Earned Value Analysis.

Harry was up and running, feeding reporting variances between the budget and actual numbers back into the constantly evolving strategy, recasting profit projections and changing assumptions in the forecast, taking cues back into the cash flow forecast. Harry put his managers through an introductory project management course, to arm them with the skills to manage properly. Projects were being evaluated on an ongoing basis and red flags were being raised to identify ‘scope creep’ and ‘wheel spin’ without Harry even needing to roll his sleeves up.

The best thing was, now Harry was happy again and his creativity and confidence came bounding back. Pretty soon Harry was landing big contracts and designing award winning buildings.

All the trappings

Sometime later Harry invited Andrew around for a catch up at his house. Andrew was shown in by the maid, to find Harry perched back in his comfortable armchair, on the deck of his beautiful clifftop house with views spanning out over the water to the horizon.

Harry takes a short pause, then looking out glistening bay, as the sun’s rays’ shimmer and the sets of waves roll in, goes on to say, “This Andrew, is the most satisfying design job I’ve ever done”

In his humble way, Harry went on “Andrew without your Virtual CFO help, I’d have probably gone broke, or worked myself to an early grave. Now my business is allowing my family to thrive. Thank you.”

——————————————————————————————————————————————————————————————————————————————————————————————————–

The specialist skillset, such as that offered by a VCFO, can only be obtained from years of training and experience that goes well beyond bookkeeping and traditional compliance accounting. The difference between Virtual CFO’s and traditional accountants, and the difference between Virtual CFO’s and bookkeepers, is that besides being fully qualified CA’s and CPA’s, Virtual CFOs have many years of industry experience. That means they can communicate within and across organisations, speaking the same language, avoiding typical accounting jargon. They are team players because their reputation and success align with the organisations that they serve.

The first step for any growing SME is to recognise they have reached this point – then they need to find help, just as Harry the Architect did. These businesses tend to have a much higher prospect of being successful.

Business owner’s like Harry need to surround themselves with the right people with the right skills because the ramifications of getting it wrong can be devastating.

Virtual CFO’s communicate and act as a conduit between the many stakeholders and the owners. Virtual CFOs give the owners a credible sounding board for their ideas as they seek to seize growth opportunities, before they engage with external stakeholders, like shareholders, banks and lenders. Virtual CFO’s are a considerable asset when raising capital because they give those stakeholders confidence knowing the VCFO, who is an independent financial professional with integrity (CA or CPA) has done a prior sense check. A Virtual CFO also creates a buffer between the owner getting dragged into financial matters which distract them from focusing on their clients and growing their business.

David Dillon is a committee member of the Virtual CFO Association.

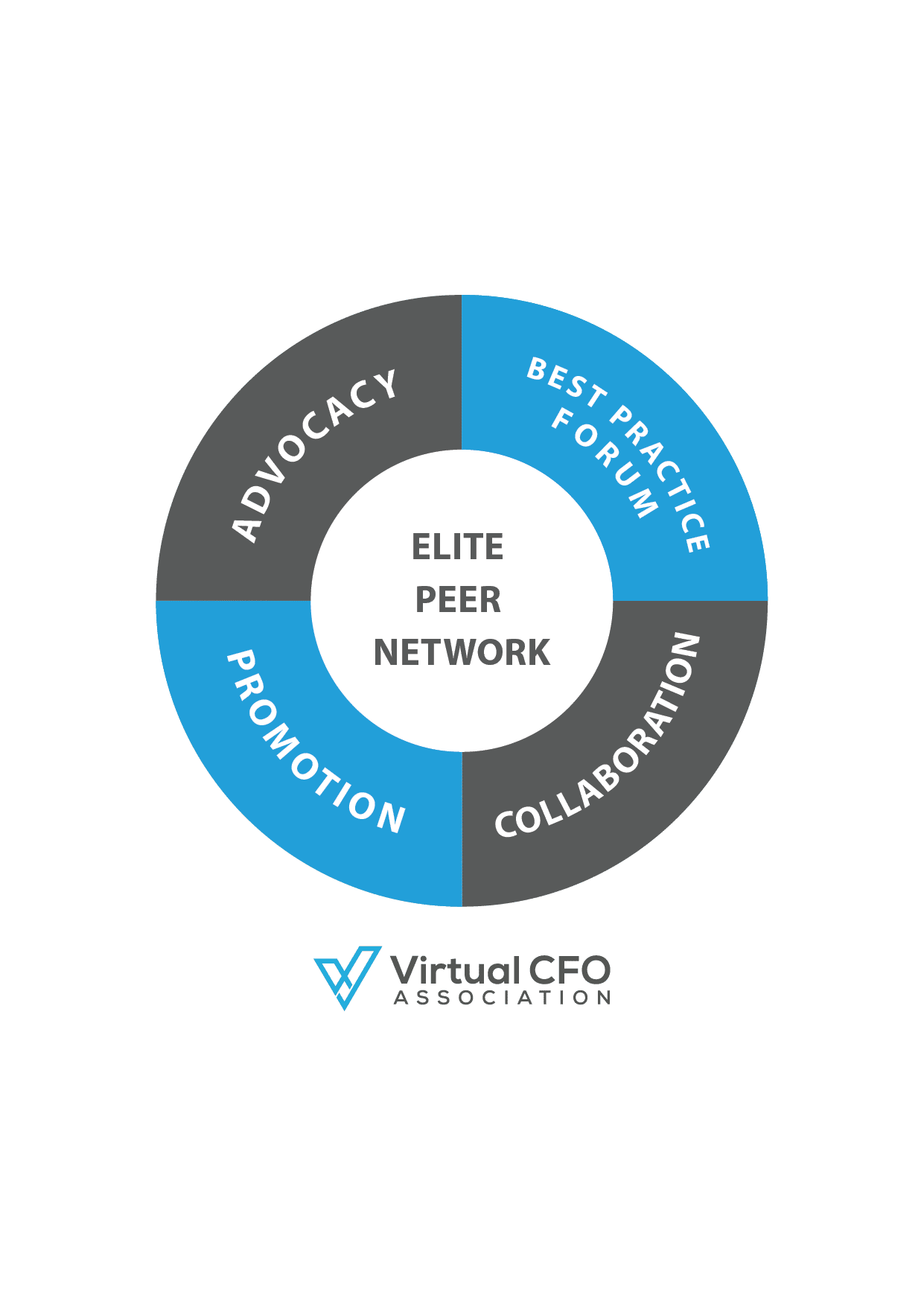

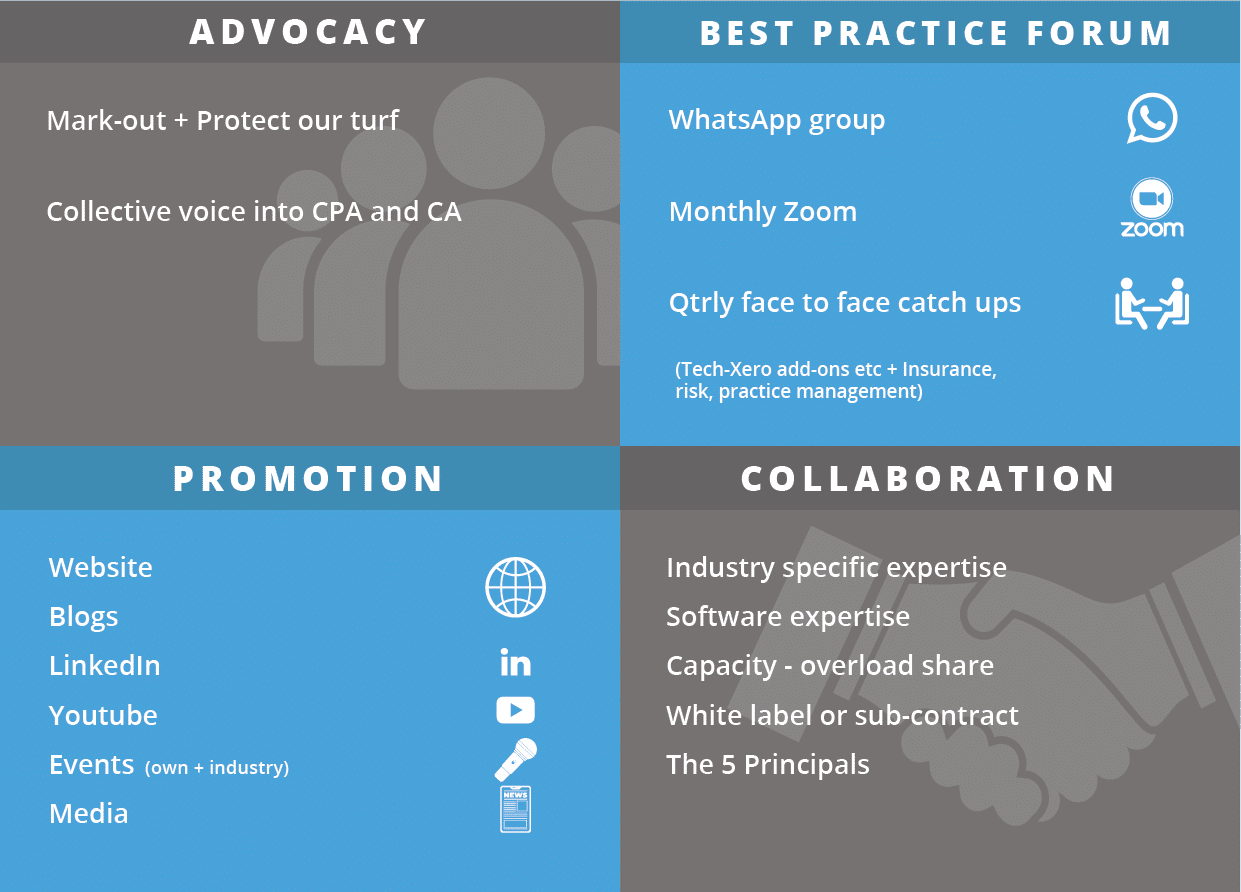

The Virtual CFO Association is an elite peer network, advocating and promoting the emerging Virtual CFO sector within the accounting profession. Collectively the association currently has almost 500 years of industry experience, with highly qualified and experienced specialists spread across more than 20 industry verticals.

If you would like any more information regarding the Association of Virtual CFO’s, or a copy of our free e-book “So, you want to be a Virtual CFO” please visit our homepage